Table of Contents

Sanlam Money Market Fund in Kenya

The Sanlam Money Market Fund in Kenya is a preferred investment option for individuals and institutions seeking low-risk, liquid investments. This fund primarily invests in short-term, high-quality debt instruments such as government securities, commercial paper, and bank deposits. With a focus on capital preservation and stable returns, it remains a go-to choice for investors looking to grow their wealth while maintaining accessibility to their funds.

Key Features of Sanlam Money Market Fund in Kenya

To help investors make informed decisions, here are the key features of the Sanlam Money Market Fund in Kenya:

- Low Risk: The fund invests in secure, short-term debt instruments, ensuring that capital is protected.

- Competitive Returns: It aims to provide higher yields than traditional savings accounts, making it an attractive investment option.

- High Liquidity: Investors can easily access their funds, with minimal withdrawal restrictions.

- Professional Management: The fund is managed by Sanlam’s experienced investment professionals, ensuring optimal risk-adjusted returns.

- Flexible Investment Options: Investors can choose from lump-sum investments, systematic savings, or systematic withdrawals.

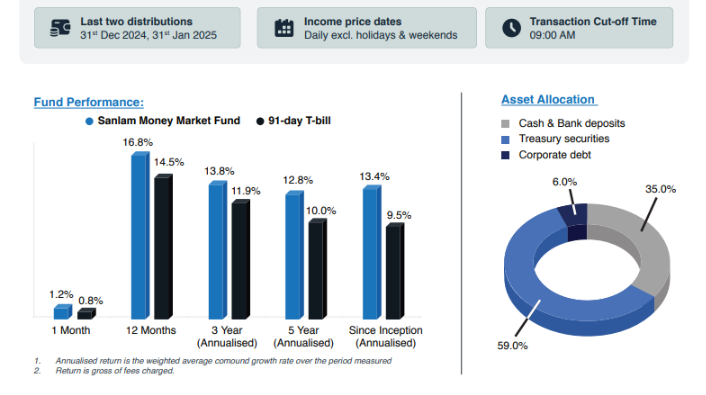

Performance of the Sanlam Money Market Fund

The performance of the Sanlam Money Market Fund in Kenya is measured through its annualized yield, which reflects returns over a specific period. As of March 2025, the fund continues to perform competitively compared to other money market funds in Kenya. However, actual returns may vary based on market conditions and the fund’s investment strategy.

How to Invest in the Sanlam Money Market Fund in Kenya

Investing in the Sanlam Money Market Fund in Kenya is a straightforward process. Here’s how you can start:

- Open an Account: Investors can open an account through Sanlam’s official website, financial advisors, or by visiting a Sanlam office.

- Deposit Funds: A minimum initial investment is required, with options for additional contributions.

- Monitor and Manage: Investors can track their investments online and adjust contributions or make withdrawals when needed.

Investment Options

Sanlam offers flexible investment options tailored to different investor needs:

- Lump Sum Investment: Suitable for individuals with a significant amount to invest at once.

- Regular Savings Plan: Allows investors to make periodic contributions, starting from KES 1,000 per month.

- Systematic Withdrawal Plan: Provides a steady income stream, ideal for retirees or individuals seeking passive income.

Fees and Charges

The Sanlam Money Market Fund in Kenya charges management fees, which cover administrative expenses and fund management services. Investors should review the fund’s prospectus or contact Sanlam Kenya directly for detailed fee structures.

Accessibility and Account Management

Investors can access the Sanlam Money Market Fund through multiple channels:

- Sanlam Offices: Visit physical branches for in-person assistance.

- Financial Advisors: Licensed professionals can guide investment decisions.

- Online Investment Platforms: Digital access allows investors to manage their funds conveniently.

Why Choose the Sanlam Money Market Fund in Kenya?

The Sanlam Money Market Fund in Kenya stands out due to its strong track record, professional management, and investor-friendly features. Whether you are an individual investor or a business looking to park surplus funds, this fund provides a secure and accessible investment avenue.

Benefits of Investing in the Sanlam Money Market Fund:

- Safety: Low exposure to market volatility.

- Liquidity: Easy withdrawals with minimal processing time.

- Competitive Interest Rates: Higher returns compared to traditional savings accounts.

- Convenience: Multiple investment and withdrawal options.

Final Thoughts on the Sanlam Money Market Fund in Kenya

The Sanlam Money Market Fund in Kenya continues to be a top-tier investment option for those looking to preserve capital while earning stable returns. It offers high liquidity, low risk, and professional management, making it an excellent choice for individuals and institutions alike. As of March 2025, it remains a trusted and competitive investment vehicle in Kenya’s financial market.

For more details, visit the official Sanlam Kenya Money Market Fund page.

Are you ready to invest in a secure and profitable future? Explore the Sanlam Money Market Fund in Kenya today and take control of your financial growth!

Zimele Money Market Fund in Kenya

M-Pesa Withdrawal Charges in Kenya

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: