Table of Contents

Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions

Discover expert tips on Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions. Learn how to choose the right operator, understand fees, enhance security, and more to boost your digital transactions

Introduction

In today’s rapidly evolving financial landscape, Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions is more than just a buzz phrase—it’s a vital strategy for managing finances efficiently. With the rise of digital transactions and the need for secure, reliable services, understanding how to optimize your mobile money usage has become essential. Whether you’re an individual looking to simplify daily transactions or a business aiming for greater financial inclusion, this comprehensive guide will help you harness the full potential of mobile money in Nigeria.

Why Mobile Money in Nigeria Matters

Mobile money has revolutionized the way Nigerians conduct transactions by offering a digital alternative to traditional banking. This innovation not only enhances convenience but also bridges the gap for the unbanked population, making financial services more accessible across the country. By leveraging Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions, users can achieve higher efficiency, improved security, and reduced costs.

Key Strategies for Maximizing Your Digital Transactions

1. Choose the Right Mobile Money Operator

Choosing the Right Mobile Money Operator for Mobile Money in Nigeria

Selecting a reliable Mobile Money Operator (MMO) is the cornerstone of maximizing your digital transactions. Here are some critical factors to consider:

- Reputation & Reliability:

Operators like Paga, OPay, and Flutterwave are popular choices. For example, Paga is known for its user-friendly interface and robust customer support, while Flutterwave offers seamless integration with multiple payment methods and has established partnerships with global financial institutions. - Service Offerings:

Each operator provides different features—from quick money transfers to bill payments and savings options. Evaluate which service aligns best with your needs. - User Reviews and Testimonials:

Check feedback from existing users to gauge satisfaction levels and potential issues.

2. Understand Transaction Fees

Understanding Transaction Fees in Mobile Money in Nigeria

One of the significant aspects of digital transactions is knowing the cost associated with each transaction. Every MMO has its fee structure:

- Fee Structure Analysis:

Operators like Paystack charge 1.5% + NGN 100 per transaction. Being aware of such fees will help you manage your finances better, prevent unexpected costs, and choose the operator that offers the best value. - Comparative Analysis:

Create a comparison table to understand the fee differences among various operators.

| Operator | Fee Structure | Notable Features |

|---|---|---|

| Paga | Competitive flat fee | User-friendly interface, robust support |

| OPay | Varied fee structure | Diverse payment options, broad service coverage |

| Flutterwave | Integrated fee structure | Multiple payment methods, global partnerships |

3. Leverage Mobile Money for Financial Inclusion

Leveraging Mobile Money for Financial Inclusion in Nigeria

Mobile Money plays a crucial role in boosting financial inclusion, particularly for populations with limited access to traditional banking. Here’s why:

- Accessibility:

Mobile money services enable users to perform financial transactions without the need for a bank account, offering an efficient alternative for the rural and unbanked communities. - Empowerment through Technology:

Empower individuals by providing a platform for savings, investments, and secure transactions—key elements for economic development. - Government Initiatives:

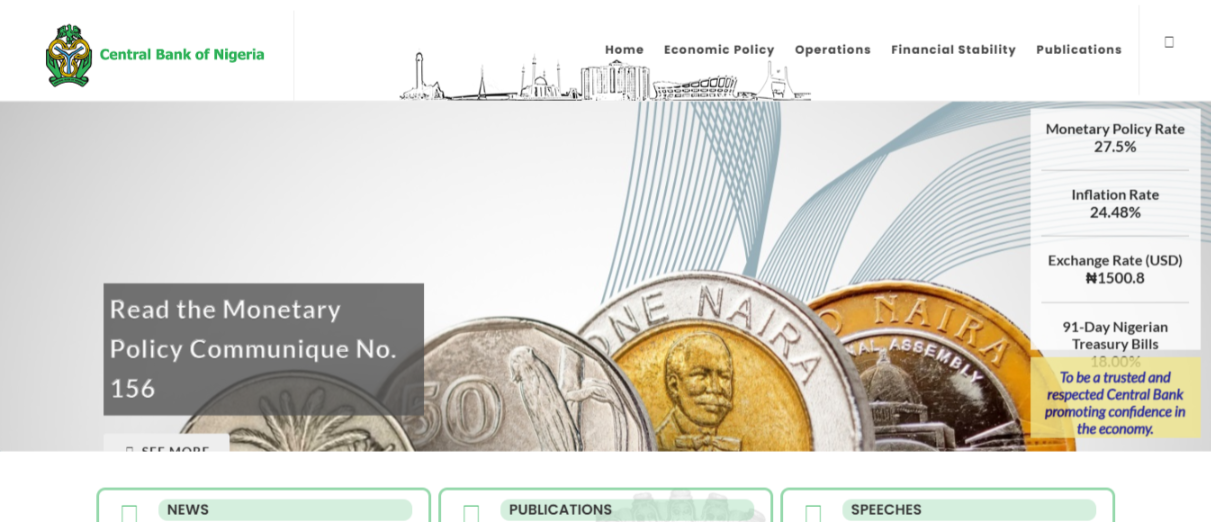

Stay updated with initiatives from the Central Bank of Nigeria, which continues to support policies that enhance financial inclusion.

4. Enhance Security Measures

Enhancing Security Measures for Mobile Money in Nigeria

With digital transactions comes the responsibility of ensuring your security. Given the rise in cyber threats, implementing robust security measures is non-negotiable:

- Strong Passwords & Two-Factor Authentication:

Use complex passwords and enable two-factor authentication on your mobile money apps. - Regular Updates:

Keep your application updated to protect against the latest vulnerabilities. - Phishing Awareness:

Be cautious of unsolicited messages and links. Only use secure networks when conducting transactions.

5. Utilize Mobile Money for Various Transactions

Utilizing Mobile Money for Diverse Transactions

Mobile money is versatile—it goes beyond mere money transfers:

- Bill Payments & Purchases:

Use mobile money to pay utility bills, purchase goods and services, and even manage savings. - Investment Opportunities:

Some platforms offer micro-investment options, letting you grow your finances directly from your mobile wallet. - Convenience & Efficiency:

With a well-integrated system, your everyday transactions become streamlined and more efficient.

6. Stay Informed About Regulatory Changes

Staying Updated on Regulatory Changes in Mobile Money in Nigeria

Regulatory changes are an inevitable part of digital financial services. Keeping abreast of these changes can help you optimize your use of mobile money:

- Government Policies:

For instance, recent policy changes by the Central Bank of Nigeria aim to bolster cybersecurity and promote financial inclusion. Regularly checking official announcements ensures that you’re always compliant. - Industry News:

Follow industry leaders and financial news outlets to stay informed on the latest trends and updates.

7. Explore International Transfer Options

Exploring International Transfers with Mobile Money in Nigeria

For Nigerians dealing with international transactions, mobile money offers competitive international transfer options:

- Competitive Fees:

Platforms like MTN Mobile Money provide international transfer services at competitive rates, ideal for Nigerians abroad or businesses dealing with cross-border transactions. - Ease of Use:

With simple interfaces and fast processing times, sending money internationally becomes as seamless as domestic transactions. - Currency Conversions:

Be aware of exchange rates and conversion fees to maximize your savings on international transfers.

8. Take Advantage of Promotions and Discounts

Maximizing Savings with Promotions and Discounts on Mobile Money

Many mobile money operators offer periodic promotions to attract and retain customers:

- Seasonal Discounts:

Keep an eye on seasonal promotions and discount offers which can reduce transaction costs significantly. - Loyalty Programs:

Some operators offer loyalty programs that reward frequent users with additional benefits and lower fees. - Exclusive Deals:

Subscribe to newsletters or follow operators on social media to be the first to know about these exclusive deals.

9. Educate Yourself on Security Best Practices

Continuous Learning: Security Best Practices for Mobile Money in Nigeria

Educating yourself about the security features available is crucial for minimizing risks:

- Online Courses & Webinars:

Participate in webinars and online courses focusing on digital security. These resources often provide the latest insights into safeguarding your transactions. - Community Forums:

Engage in community forums where users share their experiences and tips on maintaining security when using mobile money services. - Regular Reviews:

Regularly review and update your security practices based on the latest recommendations from security experts.

Final Thoughts on Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions

In summary, mastering Mobile Money in Nigeria: Tips for Maximizing Your Digital Transactions means selecting a trusted operator, understanding transaction fees, and leveraging the platform for a variety of transactions. Embracing financial inclusion, maintaining stringent security protocols, and staying abreast of regulatory changes are all critical to thriving in the digital economy. With features like international transfers, regular promotions, and continuous learning on security best practices, mobile money can transform how you handle finances in Nigeria.

By following the guidelines outlined in this post, you’re well on your way to maximizing convenience, cost-efficiency, and overall transaction security. Remember, digital financial management is an evolving field—stay informed, continuously optimize your practices, and take advantage of every opportunity to enhance your digital transactions.

If you found these tips valuable, consider subscribing to our newsletter for more insights on digital financial management and mobile payments. Also, explore our related posts on Digital Banking Trends in Africa and Cybersecurity for Digital Transactions to further empower your financial

How to Launch an Online Tutoring Business in Nigeria

How to Make Money Online in Nigeria

ATM Fees Nigeria Banks: Updated Charges and How to Avoid Extra Costs

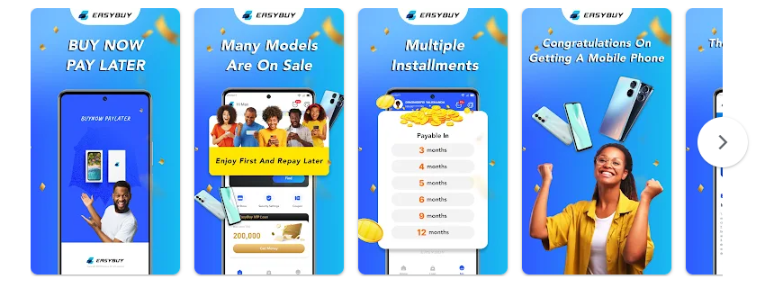

EasyBuy App in Nigeria: How to Buy Smartphones on Installment

Instant OTP in Nigeria: How to Get One Instantly for Secure Transactions

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: