Table of Contents

M-Pesa Withdrawal Charges in Kenya

Understanding M-Pesa Withdrawal Charges in Kenya

M-Pesa, Kenya’s leading mobile money service, offers a convenient way to send, receive, and withdraw money. However, M-Pesa withdrawal charges in Kenya vary depending on the amount being withdrawn. Knowing these charges helps users plan their transactions efficiently while avoiding unnecessary costs.

M-Pesa Withdrawal Charges in Kenya (March 2025)

Below is a breakdown of M-Pesa withdrawal charges from M-Pesa agents:

| Withdrawal Amount (KES) | Withdrawal Charge (KES) |

|---|---|

| 100 and below | 10 |

| 101 – 500 | 19 |

| 501 – 1,000 | 27 |

| 1,001 – 1,500 | 35 |

| 1,501 – 2,500 | 44 |

| 2,501 – 35,000 | 56 |

Important Information About M-Pesa Withdrawals

- Maximum Withdrawal Limit: The highest amount you can withdraw from an M-Pesa agent in a single transaction is KES 35,000.

- Daily Withdrawal Limit: Users can withdraw up to KES 140,000 per day.

- Transaction Fees: Charges apply only for withdrawals. Sending money, paying bills, and other M-Pesa transactions may have different costs.

How to Withdraw Money from M-Pesa

Withdrawing money from M-Pesa is a straightforward process. Follow these steps:

- Go to an M-Pesa Agent: Locate an authorized M-Pesa agent near you.

- Open M-Pesa Menu: Dial *334# or use the Safaricom App.

- Select “Withdraw Cash”: Choose the withdrawal option from the menu.

- Enter the Agent Number: Provide the M-Pesa agent number as displayed at the shop.

- Enter the Amount: Specify the amount you want to withdraw.

- Confirm the Transaction: Enter your M-Pesa PIN to complete the process.

- Receive Cash: The agent will give you the requested amount after confirming the transaction.

Factors Affecting M-Pesa Withdrawal Charges in Kenya

M-Pesa withdrawal charges in Kenya are determined by:

- Amount Withdrawn: Higher withdrawals attract higher charges.

- Type of Transaction: Agent withdrawals may differ from ATM or bank withdrawals.

- Regulatory Changes: Safaricom adjusts M-Pesa fees based on government regulations and operational costs.

How to Minimize M-Pesa Withdrawal Costs

To save money on M-Pesa transactions, consider the following:

- Withdraw Larger Amounts: Instead of multiple small withdrawals, withdraw a larger sum at once to reduce cumulative charges.

- Use Lipa na M-Pesa: If making payments, opt for Lipa na M-Pesa to avoid withdrawal fees.

- Check for Promotions: Safaricom occasionally offers fee waivers or discounts on transactions.

Comparing M-Pesa with Other Mobile Money Services

M-Pesa remains the most widely used mobile money service in Kenya, but it faces competition from:

- Airtel Money – Offers competitive rates with free peer-to-peer transactions.

- T-Kash (Telkom Kenya) – Provides lower withdrawal fees for specific amounts.

- Equitel Money – Integrated with Equity Bank for seamless mobile banking.

External Resources for M-Pesa Users

For updated M-Pesa rates and policies, visit the official Safaricom website: Safaricom M-Pesa

Final Thoughts on M-Pesa Withdrawal Charges in Kenya

Understanding M-Pesa withdrawal charges in Kenya allows users to manage their transactions effectively. By leveraging cost-saving strategies and staying updated on fee changes, M-Pesa users can make informed financial decisions. Always verify charges on the Safaricom website to avoid unexpected costs.

For more informative guides on mobile money and financial services, explore our latest blog posts!

Disclaimer: M-Pesa charges are subject to change. Always check with Safaricom for the most accurate and up-to-date fee structures.

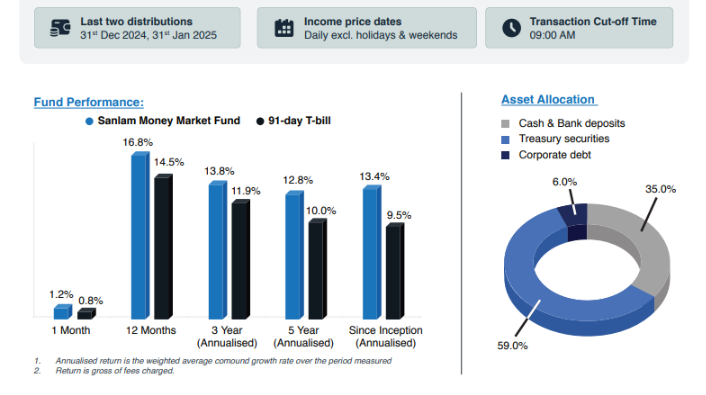

Sanlam Money Market Fund in Kenya

Zimele Money Market Fund in Kenya

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: