Table of Contents

GTBank Internet Banking in Nigeria: A Complete Guide

GTBank internet banking in Nigeria is a secure and convenient way for customers to manage their finances online. With real-time transactions, fund transfers, bill payments, and advanced security features, GTBank’s digital banking platform allows users to perform banking operations from anywhere in the world.

In this guide, we’ll cover the key features, services, security measures, and login process for GTBank internet banking in Nigeria. Whether you’re a new or existing customer, this comprehensive guide will help you maximize the benefits of online banking.

Key Features of GTBank Internet Banking

GTBank internet banking in Nigeria provides a range of digital banking solutions, ensuring customers have seamless access to financial services. Below are the essential features:

1. Real-Time Transactions

- Instant processing of fund transfers and payments.

- 24/7 access to banking services without visiting a physical branch.

- Secure and reliable platform for carrying out transactions.

2. Account Management

- View real-time account balances.

- Monitor recent transactions and download account statements.

- Request, confirm, or stop cheques.

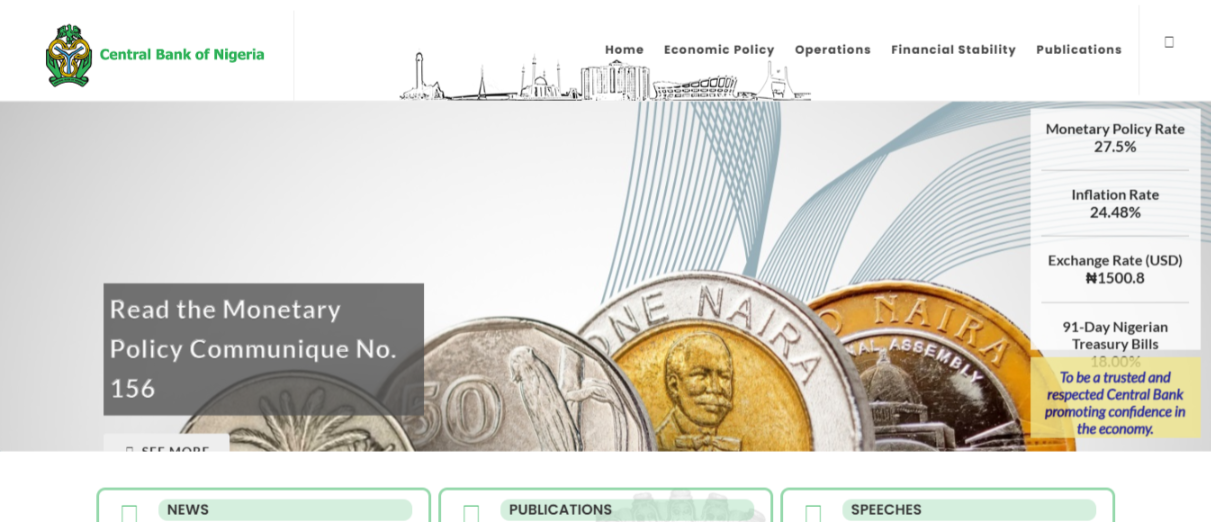

- Link BVN and NIN to comply with regulatory requirements.

3. Fund Transfers

- Transfer money between your GTBank accounts.

- Send funds to other GTBank customers instantly.

- Make third-party transfers to other banks in Nigeria.

- Pay bills, including utilities, cable TV, and internet services.

4. Security Features

- Multi-layer authentication, including PIN, fingerprint, and facial recognition.

- Secure access from any location with encrypted login.

- Two-factor authentication (2FA) for additional security.

5. Additional Online Banking Services

- Pay your US Visa application fee online.

- Buy airtime, data bundles, and pay for subscription services.

- Access banking services via GTWorld and GTBank mobile apps.

- Use the video banking service to communicate with customer service representatives in real-time.

6. Business Internet Banking Services

For business owners, GTBank internet banking in Nigeria offers:

- GAPS (Guaranty Trust Bank Automated Payment System): A real-time platform for payments and transaction monitoring.

- Business Internet Banking: Manage payroll, approve transactions, and generate e-statements.

- GeNS Email Alerts: Get instant notifications for banking transactions.

How to Log In to GTBank Internet Banking in Nigeria

Step 1: Visit the GTBank Internet Banking Portal

- Open your web browser and go to GTBank Internet Banking.

Step 2: Enter Your Credentials

- Enter your username and password to log in.

- If you’re a first-time user, follow the registration process to set up your account.

Step 3: Enhance Security

- Ensure you are using a secure internet connection (avoid public Wi-Fi).

- Enable two-factor authentication (2FA) for added protection.

- Regularly update your password to prevent unauthorized access.

Why Choose GTBank Internet Banking in Nigeria?

GTBank’s digital banking services are designed to improve convenience, security, and efficiency. Here’s why customers prefer GTBank internet banking in Nigeria:

| Feature | Benefit |

|---|---|

| 24/7 Banking Access | Perform transactions at any time without visiting a branch. |

| Instant Transfers | Send money in real-time to any GTBank or third-party account. |

| Security Measures | Multi-layer authentication and fraud protection. |

| Bill Payments | Pay for services, utilities, and subscriptions seamlessly. |

| Business Banking | Advanced tools for business owners, including bulk transfers. |

Common Issues and How to Fix Them

While GTBank internet banking in Nigeria is reliable, customers may occasionally face login or transaction issues. Here are some common problems and solutions:

1. Forgot Password or Username?

- Click on the “Forgot Password” option on the login page.

- Follow the steps to reset your credentials using your registered email or phone number.

2. Transaction Not Processing?

- Check if your account has sufficient balance.

- Ensure your internet connection is stable.

- Verify that the GTBank system is not undergoing maintenance.

3. Two-Factor Authentication (2FA) Not Working?

- Check if your registered phone number is active.

- Update your security settings through customer support if necessary.

Final Thoughts on GTBank Internet Banking in Nigeria

GTBank internet banking in Nigeria provides an efficient, secure, and seamless banking experience for individuals and businesses. With real-time transactions, bill payments, fund transfers, and enhanced security measures, customers can enjoy full control over their finances anytime, anywhere.

If you’re looking for a hassle-free way to manage your banking needs, sign up for GTBank internet banking today and experience the convenience of digital banking.

For more details and account setup, visit GTBank Internet Banking.

ATM Fees Nigeria Banks: Updated Charges and How to Avoid Extra Costs

EasyBuy App in Nigeria: How to Buy Smartphones on Installment

Instant OTP in Nigeria: How to Get One Instantly for Secure Transactions

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: