Table of Contents

Capfin Loan Application: How to Apply for a Capfin Loan in 2025

Applying for a Capfin loan application in 2025 is a straightforward process that allows you to access quick financial assistance when needed. Whether you prefer applying online, via SMS, or in-store, Capfin offers flexible options to suit your needs. In this guide, we will outline the step-by-step process for applying for a Capfin loan, the required documents, and key considerations to help you make an informed decision.

How to Apply for a Capfin Loan

Capfin offers three convenient methods for submitting a loan application: online, via SMS, and in-store at PEP or Ackermans.

1. Online Capfin Loan Application

Applying online is one of the quickest and most efficient methods. Follow these steps:

- Visit the Capfin loan application portal.

- Log into your profile using your South African ID number.

- Receive a One-Time-Pin (OTP) on your registered cellphone for identity verification.

- Complete the online application form by providing the required details and uploading the necessary documents.

- Submit your application and receive instant feedback regarding your loan eligibility.

2. Capfin Loan Application via SMS

For those who prefer a mobile-friendly approach, you can apply via SMS:

- Send an SMS with your South African ID number to 33005.

- Follow the instructions sent to your phone to complete your application.

3. In-Store Capfin Loan Application

If you prefer a face-to-face application, visit any PEP or Ackermans store:

- Provide your South African ID.

- Submit proof of income (last 3 payslips or bank statements).

- A store assistant will scan and upload your documents.

- Complete the application and wait for approval.

Required Documents for a Capfin Loan Application

To successfully apply for a Capfin loan, you must provide the following:

- Valid South African ID.

- Proof of income (last 3 payslips or last 3 bank statements).

- A valid South African bank account.

- A registered South African cellphone number for verification.

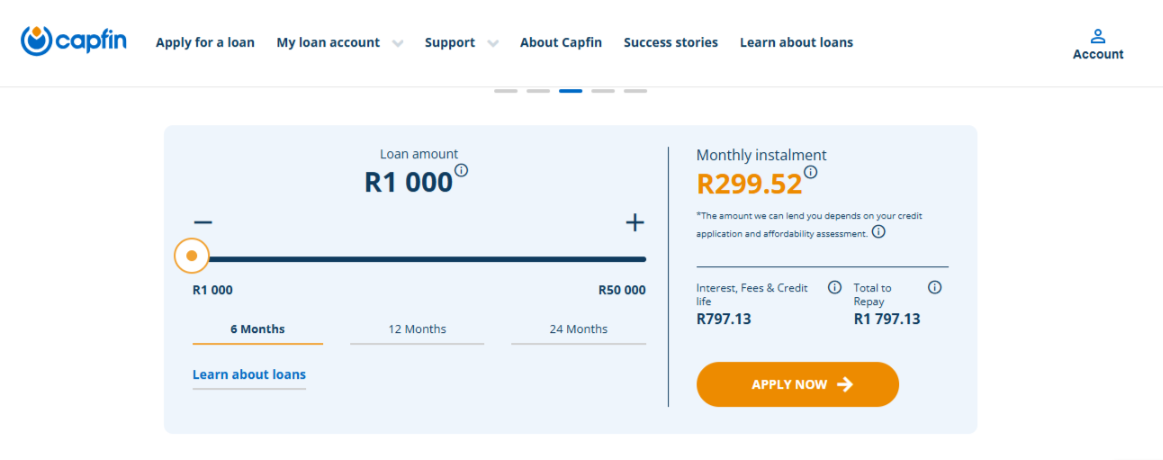

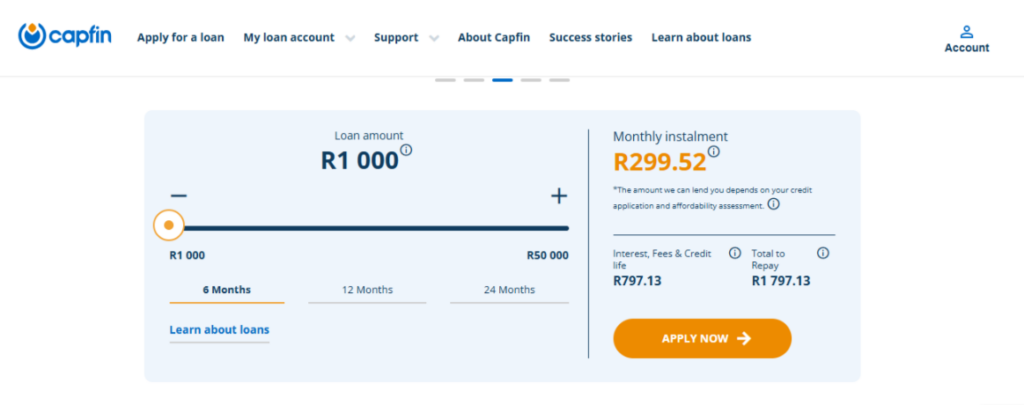

Loan Details and Calculator

Loan Amounts and Repayments

Capfin provides flexible loan amounts ranging from R1,000 to R50,000, with repayment terms suited to your financial situation.

Using the Capfin Loan Calculator

Before applying, you can estimate your repayment plan using the Capfin Loan Calculator:

- Enter your desired loan amount.

- Choose your repayment term.

- View the estimated monthly installment and total interest payable.

Capfin Loan Approval Process

Capfin aims to provide quick feedback on your application. The approval process includes:

- Identity Verification – Ensuring that the applicant meets the necessary criteria.

- Credit Assessment – Evaluating your financial history and ability to repay the loan.

- Final Approval and Disbursement – Upon approval, the loan amount is deposited directly into your bank account.

Frequently Asked Questions (FAQs)

1. How long does it take to get approval for a Capfin loan?

Capfin provides instant feedback on your eligibility. If approved, funds are typically disbursed within 24 to 48 hours.

2. Can I apply for a Capfin loan without proof of income?

No, proof of income is a mandatory requirement for a Capfin loan application.

3. What happens if my Capfin loan application is declined?

If your application is declined, you may:

- Check your credit score for potential issues.

- Ensure that you meet all the eligibility requirements.

- Try applying for a lower loan amount.

4. Can I settle my Capfin loan early?

Yes, Capfin allows early settlement without additional penalties, which can help you save on interest.

Final Thoughts on Capfin Loan Application

Applying for a Capfin loan is a simple and convenient process, with multiple methods available for submission. By ensuring that you meet the eligibility criteria and provide the required documents, you can improve your chances of quick approval. Whether applying online, via SMS, or in-store, Capfin provides flexible financial solutions tailored to your needs.

For more information, visit the official Capfin website to begin your loan application process today!

My Nedbank App is Not Working: Troubleshooting Guide

How to Check Balance on Nedbank Without App

How to Pay DStv Using Nedbank App

How to Reverse Debit Order on Nedbank App

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: