Table of Contents

ATM Fees Nigeria Banks: Updated Charges and How to Avoid Extra Costs

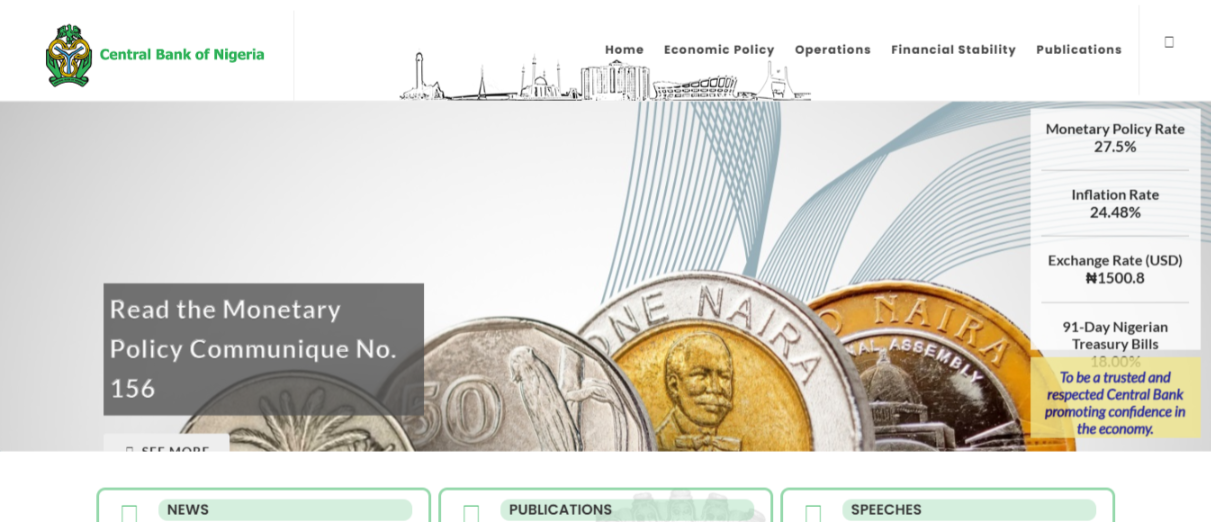

The ATM fees Nigeria banks charge have recently changed due to a revision by the Central Bank of Nigeria (CBN). As of March 2025, these updates impact withdrawals from different types of ATMs, including on-site, off-site, and international transactions. This guide provides a detailed breakdown of these fees, public reactions, and expert recommendations to help you minimize extra costs.

New ATM Fees in Nigeria (March 2025)

To improve transparency, here is a breakdown of the revised ATM fees Nigeria banks charge based on different withdrawal locations:

On-Site ATMs (ATMs Located at Bank Branches)

- Withdrawing cash from another bank’s ATM within a branch incurs a fee of N100 per N20,000 withdrawn.

- No additional charges apply for on-site ATM withdrawals.

Off-Site ATMs (ATMs Located Outside Bank Premises)

- Withdrawing cash from an off-site ATM of another bank attracts a N100 base fee per N20,000 withdrawn.

- An additional surcharge of up to N500 per N20,000 withdrawn may be applied.

- Example: Withdrawing N20,000 from an off-site ATM may cost up to N600 (N100 base fee + N500 surcharge).

International ATM Withdrawals

- Charges are now based on cost recovery, meaning customers will pay the exact processing fee applied by the international acquirer.

- Banks will notify customers of the fee before finalizing the transaction.

Additional ATM Fee Considerations

VAT Charges

- Some banks may include Value-Added Tax (VAT) of N7.50 on ATM transaction fees.

- Example: A withdrawal fee of N100 plus VAT (N7.50) totals N107.50.

Customer Notifications

- Banks now provide real-time notifications displaying ATM charges before confirming the transaction.

- Customers must approve the charges before completing withdrawals.

Public Reactions to the New ATM Fees in Nigeria

The revised ATM fees Nigeria banks charge have sparked backlash among consumers and organizations.

- Many Nigerians have expressed frustration over the increased financial burden these fees impose.

- Labour unions and civil society groups have called for a review or suspension of these charges, labeling them exploitative.

- With rising economic challenges, customers are seeking alternative banking options to avoid extra fees.

How to Avoid High ATM Fees in Nigeria

To minimize the impact of these new fees, here are some expert recommendations:

1. Use Your Bank’s ATMs

- Withdraw from your own bank’s ATMs, as these transactions remain free of charge.

2. Limit Off-Site ATM Withdrawals

- Avoid off-site ATMs of other banks whenever possible, as they carry the highest fees.

3. Consider Digital Payment Alternatives

- Use mobile banking apps, USSD codes, and POS terminals for transactions instead of withdrawing cash frequently.

- Many banks offer free or low-cost transfers through mobile banking.

4. Withdraw Larger Amounts Less Frequently

- Instead of making multiple small withdrawals, withdraw a larger sum in one transaction to reduce cumulative ATM fees.

5. Check Your Bank’s Fee Policy

- Some banks may waive or reduce fees for premium account holders. Contact your bank to explore possible exemptions.

Final Thoughts on ATM Fees Nigeria Banks

The revised ATM fees Nigeria banks charge reflect an effort to regulate cash withdrawals but have raised concerns about affordability. While using your bank’s ATMs remains free, withdrawing from another bank’s ATM—especially off-site—can attract significant charges. By leveraging mobile banking, minimizing off-site ATM usage, and checking bank policies, you can reduce unnecessary fees and manage your finances better.

For the latest updates on banking policies and financial tips, visit the official Central Bank of Nigeria (CBN) website or consult your bank’s customer service.

Related Reads:

- How to Save Money on Banking Fees in Nigeria

- Best Mobile Banking Apps in Nigeria

- EasyBuy App in Nigeria: How to Buy Smartphones on Installment

- Instant OTP in Nigeria: How to Get One Instantly for Secure Transactions

- GTBank Internet Banking in Nigeria: A Complete Guide

Do you want to start making $1000 a day without paying anything? Choose a Forex broker from the list below to promote and start earning:

Become a AvaTrade Partner

Become a XM Partner

Become a EightCap Partner

Become a HFM Partner

Become a Exness Partner

Become a FxPro Partner

If you're wondering how to make money $1000 a day for beginners without paying anything, the Forex affiliate solution is the perfect way to do it. Here’s how to get started:

Step-by-Step Guide

Register for Free at any Forex broker above.

Verify Your Identity using your ID or passport.

Access Your Dashboard and copy your referral link.

Start Promoting via WhatsApp, Facebook, TikTok, or YouTube.

Earn Passive Income whenever someone you refer starts trading.

You Don’t Need to Trade — You Just Share Your Link

Many beginners think they need to trade forex to make money — but not here. With the Exness Partner Program:

You don’t invest any money.

You don’t take any risks.

You just share your link and earn when your referrals trade.

The best part? You earn even if your referral loses money — commissions are based on trading volume, not profits.

To make real money online without paying anything, you need to promote your referral link smartly. Here are free methods that work: